top of page

Taking measures because

everything counts

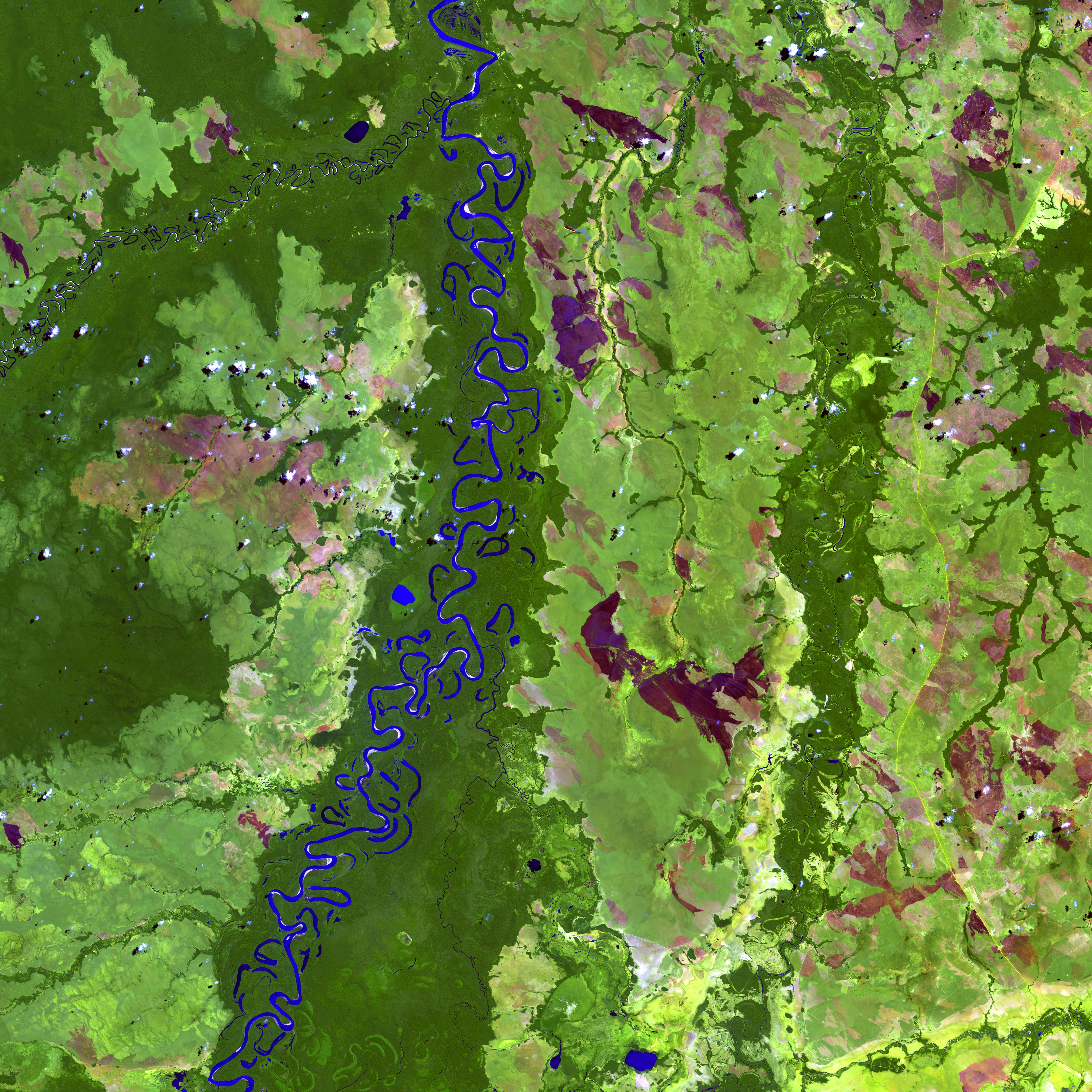

Autonomous AI and Remote Sensing technology for measuring and analysing farmlands and ecosystems to account for every tree, crop and carbon credit.

From small-holder to national-scale. Cost-effective, high-frequency solutions.

Enabling profitable, sustainable agriculture

and the conservation

of our ecosystems

We harness powerful analytics to provide business insights that boost operational efficiencies and uphold sustainable practices. Drawing insights from high-dimensional data-sets, we help innovate Nature-Based Solutions.

What We Do

Hectares covered

and counting…

400m

Faster than a

data scientist

10,000x

Cheaper and faster than a drone

90%

Use cases

globally

150+

Why Us

Going beyond...

Our Industries

Global coverage, above and

below ground

Articles

News and Updates

Headquarters

Adatos Pte Ltd,

70 Shenton Way, #13-05,

Singapore 079118

Optimise Margins

Mitigate

Risks

Restore

Nature

Our Impact

bottom of page